Attention is All Your Money Needs

20 years ago, you would have laughed if someone told you that

- you could go from deciding to pay someone and the money hitting their bank account in under 10 seconds

- investing in a stock or a fund would be less than a minute's work

- insurance premium payments would be automatic or done in less than 30 seconds

Money, in all its 2025 glory, moves fast. And yet, staying on top of it feels like an uphill battle. Allow us to explain

#1. Increasing complexity of financial products

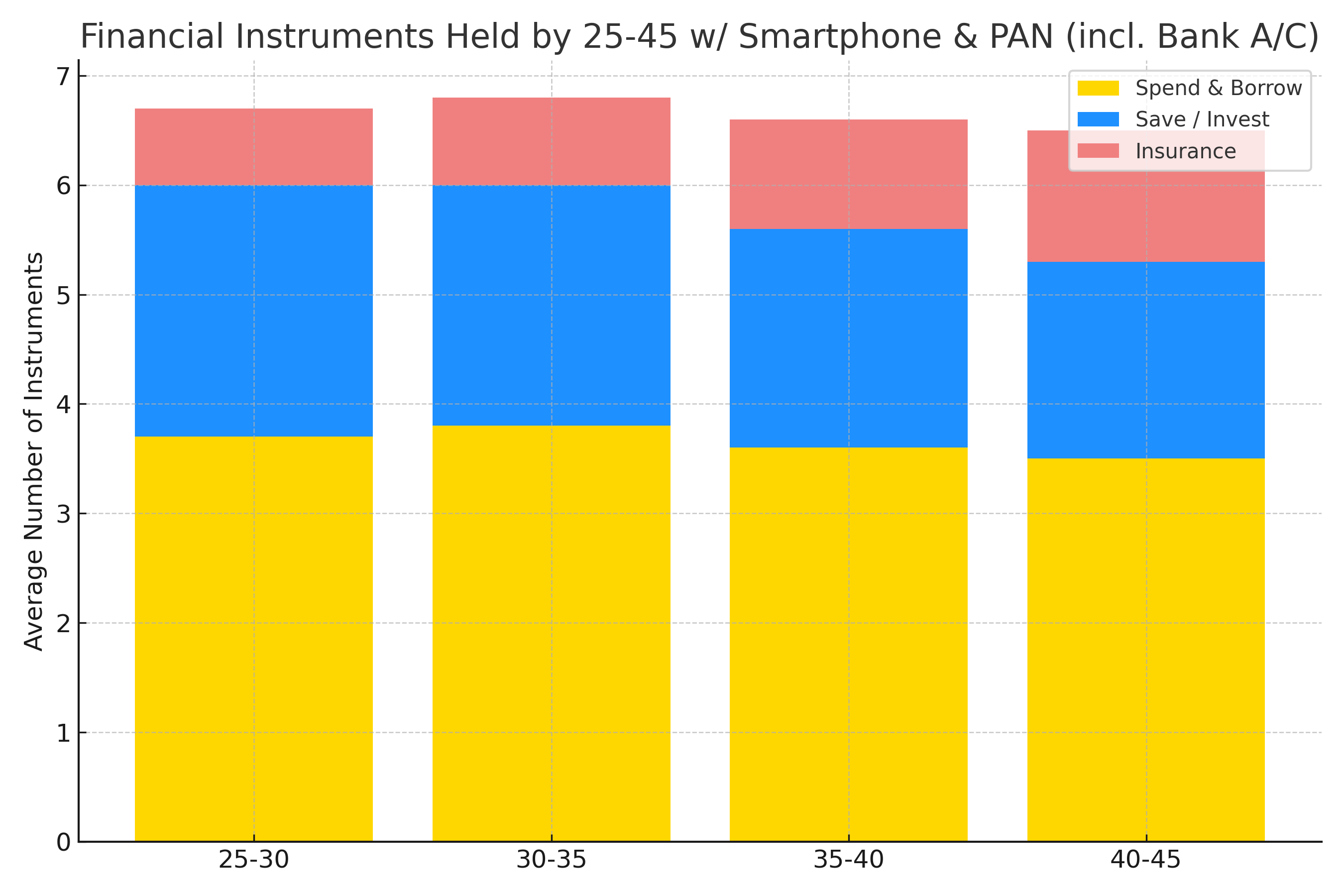

Source - RBI, NPCI, AMFI, IRDAI

On average, a working Indian (25-45y, smartphone, PAN holder = ~290m Indians) is juggling about 6 instruments across spending, saving & insuring themselves. This is only going to increase. And given the relentless march of capitalism, even the complexity of products is bound to increase.

For example, consider the universe of investing. Parag Parikh, the asset manager, is rumoured to launch a second version of their highly popular Flexi Cap Fund. A user who has heard positive reviews and wants to invest faces a dilemma: how do they choose? This scenario is common with products about to launch, like SIFs, fractional investing, or offerings emerging from the GIFT City initiative. If this sounds overwhelming, remember we haven't even touched on insurance or credit yet.

#2. Rising per-capita anxiety & stress

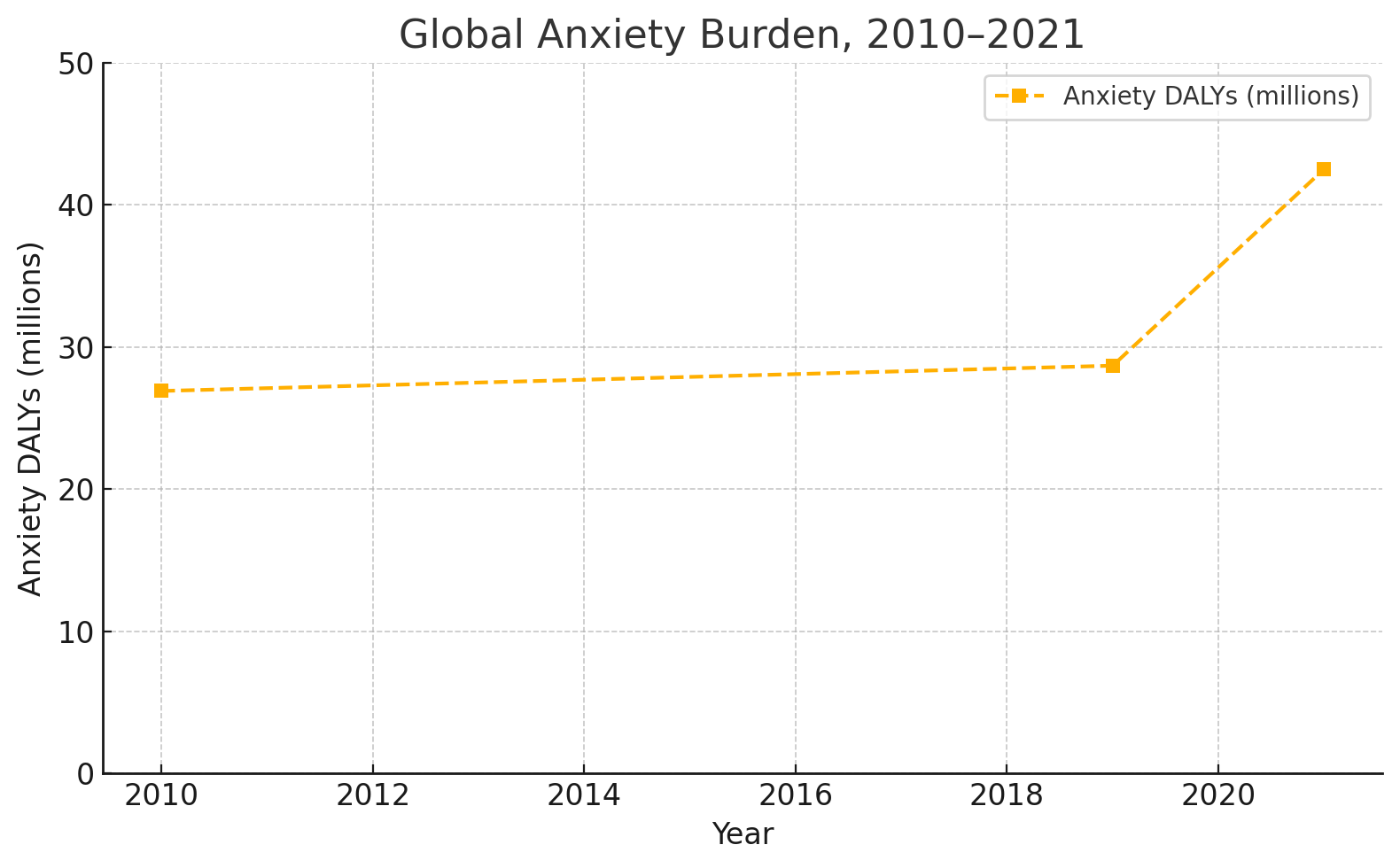

Gallup, Lancet

Coming to massive trend #2 - there's no denying the fact that we are all stressed and anxious all the time. This is causing a ripple effect with far-reaching and well-documented consequences like,

- Reduced working memory

- Comfort in unearned dopamine (yep, doom scrolling)

- Less awareness of the present

The result? A slow-burning anxiety that never goes away. One that manifests as a small voice in the back of your head asking you,

"Am I managing my money right?"

But could this be easier? What if there were to be a companion who

- has a knack for ensuring you're responsible with your spending

- knows all about you, including your dreams & aspirations

- is an expert on growing your money

- is always available to help you think through financial decisions, no matter how small or big

That's the vision behind Smooth Money: an always-on companion for your financial journey who's got your back. Yes, "a safe space for money". Where no question is too small. Where your attention is drawn to the right thing at the right time. All while keeping it very "chill".

Back to the Basics

We want to roll the financial system back to a simpler time. When money simply meant saving, spending & insuring. In case you want to perform either of these actions, an army of agents that know your personal context should be figuring out the inner mechanics of the what and the how. Not you with 20 different browser tabs or four different apps. All in a smooth, consent-first & regulatory safe manner.

Why Now?

All this while, you have operated with your money based on your (limited) understanding. It's about time someone flipped that. The future of fintech, according to us, belongs squarely in the realm of solutions, not transactions. And that's because

- Ever-improving financial infrastructure i.e. exchanges + brokers + intermediaries + regulators + payment rails reliability

- The downward slope of inference time compute & the increasing likelihood of “sentient finance”

- User comfort with leaning on AI

Your Last Line of Defence

The next significant leap in financial inclusion will be driven by Usable AI. One that matches financial products to your exact life situation. Systems that allow you to operate at a level of abstraction you are comfortable with. AI that anticipates your needs and is waiting for your approval.

There will come a day, in the very near future, when we look back and wonder how we ever managed something as complex as money without an always-on companion. And until the day personal finance doesn't become as easy as talking to a friend, we're not going to stop.

See you around,